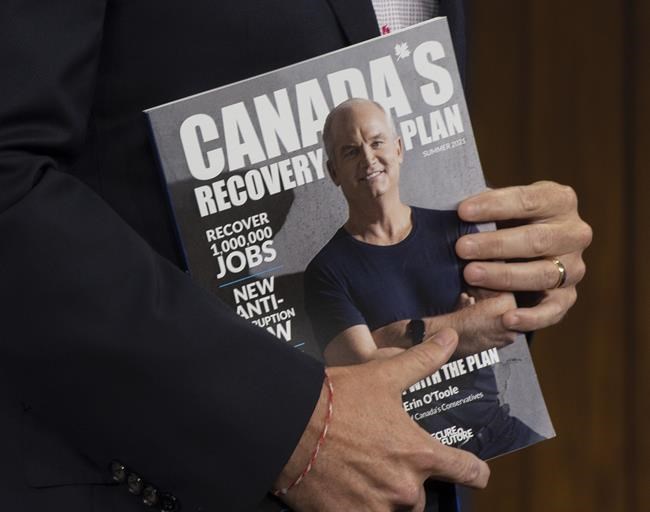

A look at key planks of Erin O’Toole’s new Conservative platform

Advertisement

Hey there, time traveller!

This article was published 16/08/2021 (1360 days ago), so information in it may no longer be current.

OTTAWA – The Conservative election platform is fully constructed, though not yet costed. Here are some key planks and pillars:

Daycare

A refundable tax credit of between $4,500 and $6,000 per child, replacing the child-care funding deals the Liberal government signed with eight premiers in recent weeks. The plan aims to cover up to 75 per cent of child-care costs for families with incomes under $30,000, and a smaller percentage for households with higher incomes.

Jobs

Payment of up to half the salary of companies’ net new hires for six months following the end of the wage subsidy, which is set to expire in late October. The benefit would cover 25 per cent for new hires, but more if they’d been unemployed for more than six months, providing an added incentive for employers to hire Canadians who’ve been out of the workforce longer.

Hospitality

A 50 per cent rebate for dine-in food and non-alcoholic drinks purchased between Monday and Wednesday for one month. The program would pump nearly $1 billion into the industry, according to Tory projections.

Tourism

A 15 per cent tax credit for vacation expenses of up to $1,000 per person for Canadians vacationing within the country next year. The Tories would also scrap the escalator tax on booze introduced in 2017.

Small business

Loans amounting to four months’ worth of pre-pandemic revenue, up to $200,000 — more than the current relief program’s $60,000 loan ceiling. Up to one-quarter of the amount would be forgivable, depending on revenue loss.

A 25 per cent tax credit on amounts of up to $100,000 that Canadians personally invest in a small business over the next two years.

Health

Federal health transfers to the provinces boosted to six per cent each year, up from the three per cent they were capped at in 2017.

Mental health

An offer to partner with provinces by dedicating a “significant portion” of that health funding to mental health.

Investing

A five per cent tax credit for any capital investment made in 2022 and 2023, with the first $25,000 refundable for small businesses.

Low-income workers

A refundable tax credit of up to $2,800 for low-income working individuals or $5,000 for families — roughly double the current amounts — paid as a quarterly direct deposit rather than an end-of-year tax refund.

This report by The Canadian Press was first published Aug. 16, 2021.